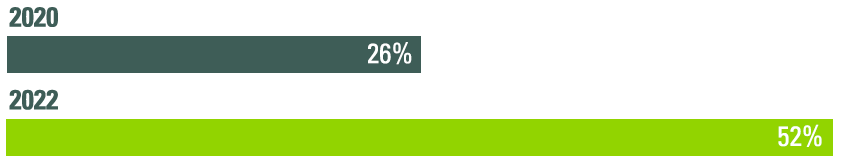

Health and wellness programs are a must-have

Recently, employees’ needs shifted with 52% now stating health and wellness programs are “must-haves” in accepting new roles.1 An LSA is an effective way to get your benefits program in shape to recruit and retain a strong workforce! It’s also a business expense tax deduction and a high-value employee benefit that’s easy to implement any time of the year.

LSAs: A benefit for every generation

Your workforce is diverse and so are employee needs for unique benefits. An LSA allows you to customize your plan based on what’s important to each generation:2

Generation Z

Mental health benefits and programs that support diversity, equity and inclusion.

Millennials

Student loan repayment, parental leave and career advancement opportunities.

Generation X

Retirement planning, caretaker benefits and more paid time off.

How an LSA works

LSAs are post-tax reimbursement accounts funded by the employer for a variety of nontraditional benefit plan expenses that aren’t covered by insurance. It’s an easy-to-administer plan that reduces administration costs and eliminates additional reimbursement management, all while allowing you to create a personalized, flexible plan and expense list that fits your employees’ unique needs.

- Employers define eligible dollar amount and frequency of contributions made to employees.

- Employers predetermine allowable expenses for reimbursement.

- Employees submit claims for reimbursement on the Member Website and HSA Bank manages substantiation and reimbursement.

- Employees get reimbursed once claims are approved, based on eligibility and availability of funds. The LSA funds used are included as taxable income on employees’ federal W-2 forms.

What an LSA can cover

An LSA can help employees save on common allowable expenses like gym memberships, computer equipment, internet expenses, personal or marriage counseling, financial planning, as well as other expenses employers feel are important for physical, mental and financial well-being. Eligible expenses may include:

Caregiver

Adoption expenses, childcare, child tutoring, elder care and pet care.

Home office

Home office furniture, computer equipment, internet provider fees and printer cartridges.

Physical well-being

Gym memberships, fitness and nutrition classes, athletic apparel, exercise equipment and massage therapy.

Mental well-being

Personal or marital counseling, life coaching, art, cooking and language courses, and spiritual or leadership retreats.

Financial well-being

Tuition and student loan payments, tutoring, financial advising, tax preparation, and estate and retirement planning.

Meal Expenses

Grocery and meal delivery services

A Lifestyle Spending Account can be added to your benefits at any time. Ready to get started? Complete the form.

1 The Rise of the Whole Employee: 20 Years of Change in Employer-Employee Dynamics. 2022.

2 “What Employee Benefits Each Generation Wants.” Nov. 2021. ObsidianHR.