Are You Retirement Ready?

Keep building your savings so you’re ready for unexpected expenses now and into retirement. HSAs are the only accounts that offer a triple-tax advantage. You can put money into it, gain interest, and use it to pay for IRS-qualified medical expenses, all tax-free.

Calculators

Our tools and calculators help you make smart decisions about your healthcare.

Try Today

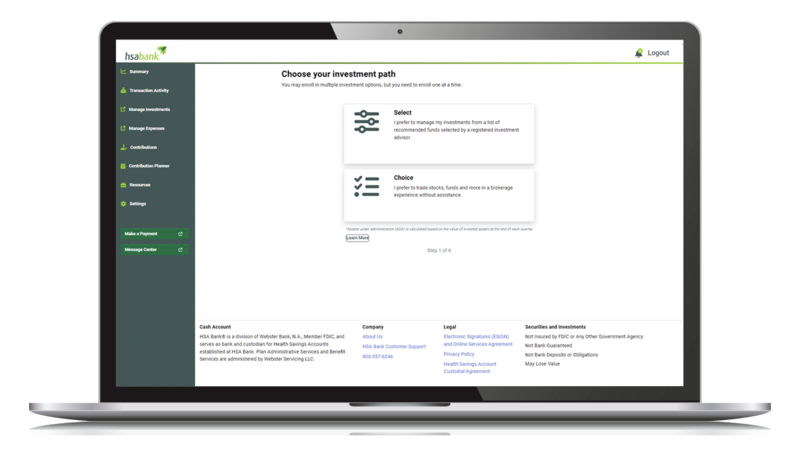

HSA Investment Options

HSA Bank provides unique opportunities to invest Health Savings Account (HSA) funds.

Learn More

Videos

Learn more about Health Savings Accounts, Consumer Driven Health Plans, 401(k)s and more.

Learn More

Review Your HSA Beneficiary

Ensure your HSA assets are protected and designate one or more individuals or organizations (such as a trust or charity) as your HSA beneficiary.